When the Market Whispers, I Listen: My Real Journey to Timing Investments for Financial Freedom

What if the best investment moves aren’t about chasing trends, but knowing when to act? I used to jump at every hot tip—until I lost more than I gained. Over years of testing strategies, making mistakes, and learning what actually works, I discovered timing isn’t luck. It’s mindset, preparation, and patience. This is not a shortcut story. It’s a real look at how aligning opportunities with personal readiness can quietly build lasting wealth. Let’s explore how to recognize those pivotal moments—without the hype or false promises.

The Myth of Perfect Timing—and Why It’s Holding You Back

Many investors operate under a powerful illusion: that there is a perfect moment to buy or sell. They imagine a clear signal—a flashing light, a headline, a gut feeling—that will confirm they are entering the market at the lowest point or exiting at the peak. This belief in flawless prediction is not only unrealistic; it is one of the most damaging habits in personal finance. Studies consistently show that the average investor underperforms the broader market, not because of poor asset selection, but because of poorly timed decisions. The tendency to buy high during periods of optimism and sell low during downturns turns potential growth into avoidable loss. This behavior is not random—it follows predictable emotional cycles driven by fear and excitement, not logic.

The truth is, no one has ever mastered the art of consistently predicting market turns. Even professional fund managers, with access to advanced analytics and real-time data, rarely outperform simple index-based strategies over time. What separates successful investors from the rest is not their ability to foresee the future, but their commitment to being consistently present in the market. The concept of time in the market being more valuable than timing the market is supported by decades of financial research. For example, an investor who remained fully invested in the S&P 500 from 1993 to 2023 would have earned an average annual return of about 10%. However, missing just the 10 best days during that period would have reduced returns by nearly half. Those best days often occur in the immediate aftermath of steep declines—precisely when fear is highest and most investors are hesitant to act.

Waiting for certainty is a strategy that leads to inaction, and inaction compounds over time. When you delay investing because you’re waiting for a clearer signal, you’re effectively betting against recovery and growth. Markets do not announce their rebounds in advance. Instead, they move on collective sentiment, economic data, and unforeseen catalysts. By the time the news turns positive, the most advantageous entry points have already passed. The psychological trap of seeking perfection prevents many from ever beginning. The alternative is not recklessness, but discipline: building a plan that allows for regular participation, regardless of short-term noise. This shift—from chasing precision to embracing consistency—forms the foundation of long-term financial progress.

Recognizing the Real Signals: What to Watch (and Ignore)

The financial world is saturated with information—earnings reports, economic forecasts, geopolitical updates, and expert commentary. For the average investor, this constant stream can feel overwhelming, even paralyzing. The challenge is not finding data, but distinguishing between what matters and what merely distracts. Real investment timing does not come from reacting to headlines or viral trends. It comes from understanding structural shifts and long-term patterns. These signals are quieter, less sensational, but far more reliable than the noise that dominates financial media. Learning to filter out emotional triggers and focus on meaningful indicators is a critical skill for anyone seeking sustainable growth.

One of the most important signals is economic context. Broad indicators such as inflation rates, employment data, and central bank policy decisions shape the environment in which markets operate. For instance, when interest rates are rising, it often signals tighter monetary policy, which can slow economic growth and pressure asset prices. Conversely, periods of low inflation and stable growth tend to support steady market appreciation. These trends unfold over months or years, not days, and they provide a backdrop against which individual investment decisions should be evaluated. Similarly, valuation metrics—such as price-to-earnings ratios across major indices—can indicate whether markets are broadly overextended or offering attractive entry points. When valuations fall below historical averages, it may suggest undervaluation, even amid negative sentiment.

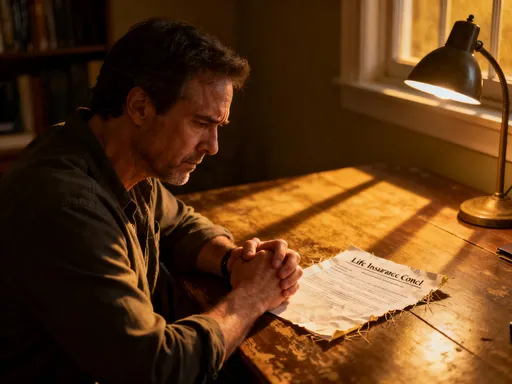

Equally important is personal financial readiness. No external signal matters if your own foundation is unstable. Before considering market timing, an investor must assess their emergency savings, debt levels, and income stability. Entering the market while carrying high-interest debt or lacking a cash buffer increases risk unnecessarily. True readiness means having a financial plan that accommodates both opportunity and uncertainty. Another overlooked signal is asset class behavior. Different investments—stocks, bonds, real estate, commodities—respond differently to economic conditions. When equities decline sharply but bonds remain stable, it may indicate a flight to safety rather than systemic collapse. Recognizing these patterns helps avoid panic selling and supports more balanced decision-making.

At the same time, investors must learn to ignore media-driven distractions. Sensational headlines generate clicks, not returns. A single corporate scandal, a geopolitical flare-up, or a celebrity endorsement rarely alters long-term fundamentals. The key is to establish a framework for evaluating information: Does this affect earnings potential over the next five years? Is it changing consumer behavior or technological trends? If not, it’s likely noise. By focusing on durable factors and tuning out short-term drama, investors gain clarity. This disciplined approach doesn’t guarantee profits, but it significantly improves the odds of making thoughtful, well-timed decisions.

Risk Control: How Timing Protects Your Capital

Investing is not just about earning returns; it’s about preserving capital so those returns have time to compound. Poor timing can turn a sound strategy into a financial setback, especially when emotions drive decisions. Entering a position too early, without confirming supporting conditions, or holding too long during a downturn, can erase years of gains. The most successful investors treat risk management not as an afterthought, but as a core component of their timing strategy. By aligning entry and exit points with clear criteria, they reduce exposure to avoidable losses and create space for long-term growth.

One of the most effective tools for risk control is position sizing. Instead of committing all available funds at once, investors can allocate smaller portions based on confidence and market conditions. For example, during a market correction, an investor might deploy 25% of intended capital initially, then add more if valuations continue to decline. This approach prevents overexposure at potentially unfavorable prices and allows for adjustment as new information emerges. It also reduces psychological pressure—knowing that not all capital is at risk at once makes it easier to stay rational during volatility.

Another powerful method is dollar-cost averaging, particularly useful for new or cautious investors. By investing a fixed amount at regular intervals—monthly or quarterly—regardless of market levels—an investor naturally buys more shares when prices are low and fewer when prices are high. Over time, this smooths out purchase costs and reduces the impact of short-term fluctuations. Historical analysis shows that dollar-cost averaging into broad market indices has produced strong long-term results, even when starting at market peaks. While it may not maximize returns in a steadily rising market, it significantly reduces the risk of large initial losses.

Equally important is the disciplined use of stop-loss strategies. A stop-loss order automatically sells a security when it drops to a predetermined price, limiting potential downside. Some investors avoid this tool, fearing it will trigger during temporary dips. However, when used thoughtfully—setting levels based on technical support or fundamental valuation ranges—it serves as a protective mechanism, not a reaction to fear. For instance, an investor might set a stop-loss at 15% below purchase price for a growth stock, acknowledging that a deeper decline could signal a structural problem. This removes the need for constant monitoring and prevents emotional decision-making during market stress. Together, these techniques form a risk-aware timing framework that prioritizes sustainability over speed.

The Hidden Clock: Aligning Investments with Life Stages

While market conditions matter, the most overlooked timing factor is personal circumstance. Your age, income, family responsibilities, and financial goals shape what kind of risk you can realistically take. A strategy that works for a 30-year-old with steady income and decades until retirement will not suit someone in their 50s preparing for reduced earnings. Recognizing this alignment between life stage and investment approach is essential for long-term success. Financial planning is not one-size-fits-all; it evolves as life does. The best timing decisions reflect not just market opportunity, but personal readiness and changing priorities.

In early career years, the primary advantage is time. Young investors can afford to take on more volatility because they have decades for compounding to work. Even significant market downturns can be recovered from, given enough time. This makes equities—particularly diversified stock index funds—an ideal core holding during this phase. Regular contributions, even in small amounts, grow substantially over 30 or 40 years. The focus should be on consistency, not perfection. Missing a few months or entering at a slightly higher price has minimal impact over such a long horizon. What matters most is starting early and staying invested.

As income grows and major life events occur—such as buying a home, starting a family, or funding education—the investment approach must adapt. These goals require more structured planning. For example, saving for a down payment on a house within five years calls for capital preservation, not aggressive growth. In such cases, short-term bonds, high-yield savings accounts, or conservative balanced funds are more appropriate than stocks. Similarly, education savings plans should align with the child’s age—more growth-oriented when young, shifting to stability as college approaches. These decisions are not about market timing alone, but about matching asset allocation to time horizon.

Approaching retirement introduces another shift. The focus moves from accumulation to income generation and capital protection. Large market declines at this stage can be devastating because there is less time to recover. Therefore, a more balanced or conservative portfolio—increasing exposure to bonds, dividend-paying stocks, and other income-producing assets—becomes essential. Strategic timing now means gradually shifting allocations over time, not making abrupt changes based on market sentiment. This staged approach, often called a glide path, ensures that risk decreases as financial independence nears. By aligning investment decisions with life milestones, investors increase their chances of meeting goals without unnecessary stress or setbacks.

Tools That Help—Without the Gimmicks

There is no magic formula for perfect timing, but there are practical tools that bring structure and clarity to the process. These are not complex algorithms or insider systems, but straightforward methods that promote discipline and reduce emotional interference. The goal is not to predict the future, but to create a repeatable process that works across different market environments. When investors rely on rules rather than reactions, they gain consistency—the single most important factor in long-term financial success.

One of the most effective tools is asset allocation. This involves dividing investments among different categories—such as stocks, bonds, and cash—based on risk tolerance and time horizon. A common guideline is the “100 minus age” rule, where the percentage of stocks in a portfolio equals 100 minus the investor’s age. While simplistic, it provides a starting point for balancing growth and safety. More sophisticated models adjust for factors like income stability, existing savings, and retirement goals. The key is not perfection, but having a clear framework that guides decisions. Rebalancing annually—selling assets that have grown too large and buying those that have lagged—ensures the portfolio stays aligned with the original strategy.

Another valuable practice is maintaining a watchlist. Instead of reacting to sudden news, investors can pre-identify securities or sectors they are interested in and track them over time. This allows for research, patience, and deliberate action. For example, an investor might add a particular industry ETF to their watchlist during a broad market sell-off, then set a target price based on historical valuation. When the price reaches that level, the purchase is made—not because of emotion, but because a predefined condition has been met. This removes impulsivity and creates a sense of control.

Finally, setting rules-based triggers helps automate decision-making. These can include buying when a market index falls below its 10-month moving average, or increasing bond exposure when inflation exceeds a certain threshold. Such rules are not foolproof, but they provide objectivity. They also make it easier to act during periods of uncertainty, when hesitation is most costly. The best systems are simple, transparent, and easy to follow. They do not promise outsized returns, but they consistently avoid the worst mistakes. Over time, this disciplined approach compounds into meaningful advantages—quietly, steadily, and without drama.

Learning from Mistakes: My Costly Lessons in Patience and Rush

No investor gets it right every time. I certainly didn’t. Some of my earliest decisions were driven by excitement, not strategy. I remember buying shares in a popular tech company after seeing a surge in its stock price and glowing media coverage. By the time I acted, the rally was nearly over. Within months, the stock corrected sharply, and I sold at a loss, frustrated and discouraged. That experience taught me the danger of chasing momentum. I had mistaken popularity for value, and timing for opportunity. The real cost wasn’t just the money lost—it was the erosion of confidence that followed.

Another mistake came during a market downturn. Fearing further losses, I sold a portion of my equity holdings and moved to cash. The market continued to decline for a few weeks, validating my decision in the short term. But then it began a strong recovery—one I missed entirely because I was too slow to re-enter. By the time I felt “safe” again, prices had already rebounded significantly. That delay cost me months of compounding growth. I had let fear override my long-term plan. These experiences were painful, but they were also transformative. They forced me to examine not just what I did, but why I did it.

What I learned was that timing is as much about self-awareness as it is about market knowledge. Impatience, fear of missing out, and overconfidence are powerful forces. They distort judgment and lead to impulsive actions. The antidote is not perfection, but process. I began journaling my investment decisions—recording not just what I bought or sold, but my reasoning, emotions, and expectations. Over time, patterns emerged. I noticed that I tended to act more aggressively after a series of gains, and more cautiously after losses—exactly the opposite of what a disciplined strategy requires. Recognizing these tendencies allowed me to build safeguards: waiting 48 hours before executing trades, consulting a checklist, or discussing decisions with a trusted advisor.

Most importantly, I learned that mistakes are not failures—they are feedback. Every misstep revealed a gap in my understanding or discipline. By treating them as learning opportunities, I became more resilient. I stopped seeking flawless results and started focusing on continuous improvement. That shift in mindset made all the difference. It allowed me to stay engaged, even during difficult periods, and to make better-timed decisions over time. Growth in investing, as in life, comes not from avoiding errors, but from learning how to correct them.

Building Your Own Timing Framework: From Theory to Practice

After years of experimentation, reflection, and adjustment, I’ve come to see that effective investment timing is not about mastering the market—it’s about mastering yourself. The most reliable framework combines external awareness with internal discipline. It uses market signals not as commands, but as inputs. It respects personal circumstances not as limitations, but as guides. And it treats every decision as part of a longer journey, not a single event. This approach doesn’t promise overnight wealth, but it does offer something more valuable: steady progress toward financial security.

To build your own framework, start by assessing your current situation. What are your financial goals? How much risk can you tolerate without losing sleep? How soon will you need access to your funds? These answers shape your strategy. Next, define your core principles. Will you use dollar-cost averaging? How often will you rebalance? What triggers will prompt a buy or sell decision? Write these rules down. A plan that exists only in your mind is easily overridden by emotion. A written plan provides clarity and accountability.

Then, establish your monitoring system. Choose a few key indicators—such as market valuations, economic trends, or personal milestones—and track them regularly. Avoid information overload; focus on what truly influences your decisions. Use a watchlist to identify opportunities in advance, and set price targets based on research, not rumors. Schedule periodic reviews—quarterly or semi-annually—to assess performance and make adjustments. Life changes, and so should your plan. But changes should be deliberate, not reactive.

Finally, cultivate patience. The most powerful force in investing is compounding, and compounding requires time. The best moments to act are often the quiet ones—when markets are flat, news is dull, and no one is talking about stocks. These are the periods when discipline pays off. Financial freedom is not built on dramatic wins, but on consistent, well-timed choices. It comes from listening to the market not for shouts, but for whispers. And when you do act, it’s not because you’re chasing a trend, but because your preparation meets opportunity. That is the real art of timing—and the quiet path to lasting wealth.