How I Mastered My Credit Cards to Perfect My Investment Rhythm

Ever feel like your credit card is working against your investment goals? I’ve been there—trapped in minimum payments while missing golden investment windows. It hit me: managing credit isn’t just about debt control, it’s about timing. When I aligned my card strategy with my investment rhythm, everything changed. No more cash crunches before market dips. This is how I turned credit stress into financial momentum—sharing the real moves that made a difference. What began as a struggle with monthly balances evolved into a disciplined system where credit cards no longer drained my resources but instead became tools for financial agility. The shift wasn’t about earning rewards or chasing perks—it was about syncing cash flow, preserving liquidity, and making smarter moves when markets offered opportunity. This is not a story of high-risk leverage, but of thoughtful alignment between everyday spending habits and long-term financial growth.

The Hidden Cost of Poor Credit Timing

Many people assume that as long as they pay their credit card bills on time, they’re managing credit responsibly. While avoiding late fees and interest is important, there’s a deeper financial consequence often overlooked: the timing of those payments can significantly impact investment readiness. When credit card spending and repayment cycles consume available cash at the wrong moment, investors may find themselves unable to act when markets dip or promising opportunities emerge. This misalignment creates what financial planners call a 'cash flow gap'—a temporary but critical shortage of liquid funds precisely when they’re needed most. The cost isn’t just measured in interest charges; it’s reflected in lost investment potential, delayed portfolio growth, and emotional frustration.

Consider a common scenario: an investor sees a market correction and wants to deploy capital into a diversified index fund. However, their paycheck has already been allocated to cover a large credit card balance due at the beginning of the month. Even if the balance was paid in full and no interest accrued, the timing locked up funds that could have been used for investment. In this case, the investor missed a strategic entry point not because of overspending, but because of poor synchronization between billing cycles and financial goals. Research from the Federal Reserve indicates that nearly 40% of U.S. households carry credit card debt month to month, but even among those who pay in full, timing inefficiencies can quietly erode investment momentum. The issue isn’t the existence of credit—it’s the failure to treat it as part of a broader financial rhythm.

Another overlooked aspect is the psychological burden of juggling multiple due dates and fluctuating balances. When mental energy is spent managing credit stress, decision-making around investments suffers. Behavioral finance studies show that financial anxiety reduces risk tolerance and delays action, even when funds are technically available. By failing to align credit use with investment timing, individuals create self-imposed constraints that limit their ability to act decisively. The solution isn’t to avoid credit altogether, but to reframe it as a tactical tool. When managed with intention, credit cards can serve as temporary bridges between income cycles and market opportunities, rather than obstacles. Recognizing this shift in perspective is the first step toward transforming credit from a liability into a strategic asset.

Matching Cash Flow to Market Cycles

Investing successfully isn’t only about choosing the right assets—it’s also about entering the market at the right time. Yet many investors focus solely on market analysis while neglecting their personal cash flow patterns. A well-researched investment thesis means little if funds aren’t available when prices are favorable. This is where synchronizing credit card billing cycles with market movements becomes essential. By forecasting personal income, expenses, and credit availability, investors can position themselves to act quickly when conditions are optimal. For example, someone who receives a monthly salary on the first of the month can plan their credit card payments toward the end of the billing cycle, preserving cash for several weeks. That window can be used to monitor market trends and prepare for potential investments.

Let’s examine a practical example. Suppose a market downturn occurs in the third week of the month. An investor who has already paid their credit card bill early in the cycle may have limited liquidity. In contrast, another investor who timed their payment for the last possible day—without incurring interest—still has access to their full paycheck. If they’ve also avoided large discretionary purchases during that period, they can redirect those funds toward investments. This doesn’t involve borrowing or taking on debt; it’s simply leveraging the grace period most credit cards offer (typically 21–25 days) to maintain flexibility. According to a 2023 report by the Consumer Financial Protection Bureau, the average grace period allows responsible users to hold onto their money for over three weeks without cost, creating a valuable window for financial maneuvering.

To implement this strategy effectively, investors should map out their monthly cash flow in advance. This includes identifying fixed expenses, variable spending, and expected income dates. Overlaying this with credit card billing and due dates allows for intentional planning. For instance, delaying a major purchase until after a market dip could free up capital for investment. Similarly, avoiding large charges during volatile periods ensures that available credit isn’t tied up unnecessarily. The key is not to chase every market movement, but to be prepared when meaningful opportunities arise. Over time, this approach builds confidence and reduces reactive decision-making. Investors begin to see their credit cards not as sources of temptation, but as instruments of timing and control—enabling them to participate in market cycles without compromising financial stability.

The 3-Phase Credit Sync Method

To turn credit card management into a repeatable system for investment readiness, a structured approach is necessary. The 3-Phase Credit Sync Method offers a clear framework: Buffer Building, Strategic Spacing, and Surge Readiness. Each phase serves a distinct purpose and builds upon the previous one, creating a rhythm that supports both financial discipline and opportunity capture. This method does not encourage spending more or carrying debt; rather, it maximizes the utility of existing credit lines through intentional timing and planning.

The first phase, Buffer Building, focuses on using the grace period to accumulate liquidity. Instead of paying the credit card bill immediately upon receiving the statement, responsible users wait until the due date—up to 25 days later. During this window, the funds that would have gone toward repayment remain in the checking or savings account, effectively creating a short-term buffer. This buffer can be used to cover unexpected expenses or held in reserve for potential investments. For example, if an investor anticipates a market correction, they might delay non-essential purchases and preserve cash during the grace period. This strategy works only when the balance is paid in full each month, ensuring no interest is incurred. It transforms the credit card into a temporary cash management tool, not a source of borrowed money.

The second phase, Strategic Spacing, involves timing large purchases to avoid cash flow conflicts. Rather than making big-ticket charges randomly, investors should align them with income cycles and market conditions. For instance, scheduling a home appliance purchase right after payday ensures that funds are available to cover the upcoming credit card bill. More importantly, avoiding large charges during periods of market volatility preserves both cash and available credit for investment use. This requires advance planning and calendar tracking, but the payoff is greater control over financial decisions. A study by the National Bureau of Economic Research found that households that planned major purchases around income cycles were 30% more likely to invest during market dips than those who did not.

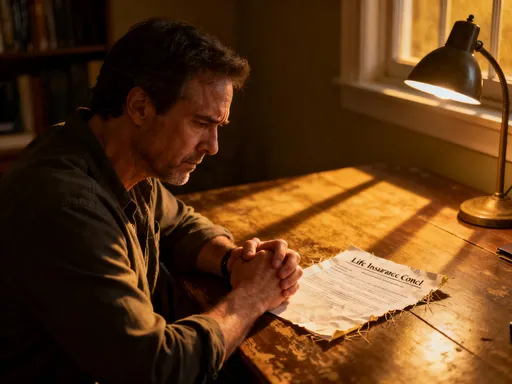

The third phase, Surge Readiness, is about maintaining one credit card with a high limit and zero balance specifically for emergency investment opportunities. This card is not used for daily spending; it’s reserved for rare, high-conviction moments when deploying capital quickly can yield significant returns. For example, during a sudden market drop, an investor might use this card to purchase shares, then repay the balance within the grace period using incoming funds. The key is strict discipline: this card must be paid in full, and its use should be governed by predefined rules, such as requiring a minimum expected return or portfolio rebalancing need. By treating credit this way, investors gain flexibility without increasing risk. Together, these three phases form a cohesive system that turns credit card management into a strategic advantage.

Avoiding the Liquidity Trap

One of the most dangerous misconceptions in personal finance is equating available credit with actual liquidity. Just because a credit card has a $10,000 limit doesn’t mean that $10,000 is spendable cash. Many otherwise disciplined individuals fall into the liquidity trap—believing they have financial flexibility when, in reality, their cash flow is already committed. This illusion can lead to poor investment decisions, such as using credit to buy stocks in anticipation of gains, only to face repayment pressure if the market doesn’t move as expected. The result is not just financial strain, but a breakdown in long-term planning and emotional confidence.

The root of this trap lies in failing to distinguish between gross and net cash flow. Gross cash flow refers to total income and available credit, while net cash flow accounts for all obligations, including fixed expenses, savings goals, and upcoming bills. Without tracking net cash flow, investors may overestimate their ability to absorb short-term debt. For example, someone with a $5,000 credit limit and a $3,000 monthly income might feel financially secure. But if rent, utilities, groceries, and insurance consume $2,800, and the credit card already carries a $2,000 balance, the true available liquidity is minimal. In such cases, using the remaining $3,000 limit for investing is extremely risky, even if the intention is to repay quickly. Market timing is uncertain, and unexpected expenses can derail repayment plans.

To avoid this trap, investors must conduct a monthly liquidity assessment. This involves listing all income sources, fixed expenses, variable spending, and upcoming obligations, then subtracting them from total available funds. Only the remaining surplus should be considered usable for investment. Additionally, it’s crucial to maintain a buffer for emergencies—typically three to six months of living expenses in liquid assets. Relying on credit as a substitute for this buffer increases vulnerability. The goal is not to eliminate credit use entirely, but to ensure that any investment made with credit is backed by a clear repayment path and does not compromise financial stability. By focusing on net cash flow rather than surface-level availability, investors protect themselves from overextension and preserve the ability to act wisely when real opportunities arise.

Balancing Rewards and Discipline

Credit card rewards—whether cashback, travel points, or statement credits—can provide tangible benefits when used correctly. For investors, these rewards represent a form of passive income that, if managed well, can enhance portfolio growth. However, the temptation to spend more in order to earn more rewards can quickly undermine financial discipline. The key is to treat rewards as a bonus, not a budget enhancer. When rewards are funneled directly into investment accounts rather than spent on additional consumption, they compound over time and contribute to long-term wealth.

Consider a card that offers 2% cashback on all purchases. If an investor spends $1,000 per month on necessary expenses—groceries, utilities, fuel—and pays the balance in full, they earn $240 annually in rewards. Redirecting that $240 into a low-cost index fund with an average annual return of 7% would grow to over $3,500 in 10 years, assuming reinvestment. This is not a windfall, but it’s a meaningful addition achieved without changing spending habits. The discipline lies in ensuring that the spending generating the rewards is already part of the budget—not inflated to chase points. Studies show that consumers who optimize rewards without increasing spending can gain an extra 0.5% to 1% in annual portfolio growth over time.

To maximize this benefit, investors should use rewards strategically. For example, allocating cashback toward tax-advantaged accounts like IRAs or 401(k)s amplifies the long-term impact. Alternatively, using points to offset travel costs for business-related financial education or networking events can indirectly support financial growth. The critical rule is to never carry a balance for the sake of earning rewards—interest charges will almost always outweigh the value of points or cashback. Additionally, rotating bonus categories should be used only for planned purchases, not as justification for impulsive spending. By maintaining strict boundaries, investors turn rewards into a disciplined tool rather than a behavioral trap.

When to Hold Back: Risk Control First

While the idea of using credit to seize investment opportunities may sound appealing, it’s essential to recognize the inherent risks. Market timing is inherently uncertain, and leveraging credit introduces an additional layer of financial pressure. The most successful investors are not those who act the fastest, but those who act with the greatest discipline. This means establishing clear personal risk thresholds and adhering to them, even when emotions run high. The goal is not to eliminate all risk, but to ensure that risk is calculated, manageable, and aligned with long-term objectives.

One effective way to maintain control is by setting strict rules for credit-based investing. For example, an investor might decide never to use more than 20% of their available credit for investment purposes, or only to do so when the expected return exceeds a certain threshold, such as 8% annually. Another rule could be requiring a minimum cash reserve—say, six months of expenses—before considering any credit-assisted investment. These rules create guardrails that prevent emotional decisions during market volatility. Historical data shows that investors who follow predefined strategies outperform those who react impulsively, particularly during downturns.

It’s also important to recognize warning signs of overextension. These include consistently carrying a balance, missing payment due dates, or feeling anxious about repayment. Any of these signals indicate that the credit-investment strategy has gone too far and needs adjustment. Financial wellness is not just about returns; it’s about sustainability and peace of mind. By prioritizing risk control, investors build resilience that allows them to stay the course over decades, not just through a single market cycle. The most powerful investment rhythm is one that endures, not one that burns out.

Building a Sustainable Investment Rhythm

True financial success comes not from isolated wins, but from consistent, repeatable habits. The integration of credit card management and investment strategy is not a one-time adjustment, but an ongoing practice. To maintain this rhythm, investors should establish a monthly review process that evaluates three key areas: credit usage, investment readiness, and emotional triggers. This review helps identify patterns, correct misalignments, and reinforce discipline. For example, examining credit card statements can reveal whether spending aligns with budget goals, while assessing investment accounts shows whether capital was deployed effectively.

During this review, investors should ask specific questions: Did I use credit in a way that supported my investment goals? Was I prepared for market movements? Did I feel pressured to make a decision due to cash flow constraints? Answering these honestly provides insight into areas for improvement. Some find it helpful to keep a financial journal, noting major decisions and their outcomes. Over time, this builds self-awareness and strengthens decision-making. Additionally, automating bill payments and investment contributions can reduce friction and ensure consistency.

The ultimate goal is to create a system where financial actions flow naturally from established principles. When credit cards are managed with intention, they no longer represent stress or temptation, but tools for empowerment. When investment decisions are made from a position of preparedness, they are more confident and effective. This rhythm doesn’t guarantee perfect timing or maximum returns, but it does create a foundation for steady progress. In the long run, wealth is not built through dramatic moves, but through disciplined, well-timed actions—repeated month after month, cycle after cycle. By mastering the relationship between credit and investment, individuals gain not just financial advantage, but lasting peace of mind.