How I Turned My Debt Crisis Around While Protecting My Gains

What happens when your debts start piling up faster than your income? I’ve been there—staring at bills, stressed about calls from creditors, and fearing I’d lose everything I’d worked for. But instead of collapsing, I found a way to stabilize my finances *without* sacrificing future gains. This isn’t about quick fixes or risky bets. It’s about smart, grounded strategies that helped me regain control, protect what I earned, and build a safer financial path forward. Let me walk you through how it actually works.

The Breaking Point: When Debt Starts Calling the Shots

There comes a moment—often quiet, unannounced—when debt stops being a background concern and becomes the central voice in your financial life. It might begin with a missed credit card payment, a utility bill pushed to next month, or a sinking realization that your paycheck disappears before the week ends. For many, especially those managing household budgets with fixed or modest incomes, this tipping point arrives not from recklessness, but from life’s predictable unpredictability: a car repair, a medical expense, or a temporary loss of income. The problem isn’t always overspending; it’s the imbalance between obligations and resources.

What makes this phase so dangerous isn’t just the numbers—it’s the erosion of confidence. When debt grows faster than income, even by a small margin, the psychological toll is real. You start second-guessing every purchase. Sleep becomes harder. The fear isn’t only about being late on a payment; it’s about losing ground on everything you’ve built. Homes, savings, retirement plans—these feel suddenly fragile. The irony is that in this state of stress, people often make financial decisions that worsen the situation: taking on high-interest loans, skipping essential payments, or chasing quick income fixes that carry hidden risks. The cycle tightens.

But here’s what most don’t realize: the crisis isn’t the end of financial stability—it can be the beginning of a smarter approach. The key is recognizing that when debt starts calling the shots, your immediate goal isn’t to eliminate it overnight. It’s to stop the bleeding. That means pausing aggressive growth strategies, delaying nonessential investments, and focusing entirely on regaining control. This isn’t defeat; it’s strategy. Just as a doctor stabilizes a patient before treating the illness, financial recovery starts with creating a stable foundation. Once you’ve done that, everything else becomes possible.

Rethinking the Goal: Stability Before Growth

In normal financial times, the advice is clear: save, invest, grow. But during a debt crisis, that same advice can be dangerously misplaced. The instinct to chase high returns—whether through aggressive stock trades, speculative side ventures, or accelerated debt payoff plans—often backfires. Why? Because under financial pressure, risk tolerance shrinks. A single setback—a delayed payment, an unexpected expense—can unravel even the best-laid plans. That’s why the first strategic shift isn’t about money at all. It’s about mindset.

The new priority must be stability, not growth. This means protecting what you already have: your income, your home, your credit standing, and your peace of mind. It means accepting that for a season, wealth accumulation takes a back seat to wealth preservation. This isn’t a sign of failure; it’s a sign of wisdom. Think of your finances like a house. If the roof is leaking, you don’t repaint the walls. You fix the roof first. Similarly, when debt threatens your financial structure, the focus must be on reinforcement, not expansion.

Stability is built on predictability. That means ensuring your monthly income reliably covers essential expenses, that you’re not one emergency away from default, and that you have a clear view of your obligations. It also means resisting the temptation to take on new debt to solve old debt—like using a home equity loan to pay off credit cards without changing spending habits. These moves may feel like progress, but they often shift the problem rather than solve it. True stability comes from aligning your lifestyle with your income, not from borrowing against the future.

Protecting gains is just as important as earning them. The money you’ve saved, the home you’ve maintained, the retirement contributions you’ve made—these represent years of effort. A debt crisis shouldn’t erase them. By focusing on stability first, you create the conditions under which those gains can survive, and eventually, grow again. This approach isn’t flashy, but it’s sustainable. And in the long run, sustainability beats speed every time.

The Income Firewall: Protecting Your Earnings First

If debt is the fire, income is the water. But too often, people try to douse the flames without protecting their water source. The most critical step in a debt recovery plan is building an income firewall—your first line of defense against financial collapse. This means treating your earnings not just as money to spend, but as the foundation of your recovery. Without steady income, no strategy works. With it, nearly every challenge becomes manageable.

The firewall starts with budget realignment. This isn’t about cutting out coffee or entertainment—though small savings help. It’s about reorganizing your cash flow to protect essentials: housing, utilities, food, transportation, and minimum debt payments. Every dollar should be assigned a job. This is where zero-based budgeting proves powerful: every income dollar is allocated, so nothing slips through the cracks. The goal isn’t deprivation; it’s clarity. When you know exactly where your money goes, you regain control.

Next comes negotiation. Many people don’t realize they can talk to creditors. Credit card companies, utility providers, even medical billing offices often offer hardship programs—temporary payment reductions, interest waivers, or extended terms. These aren’t handouts; they’re risk-management tools for lenders who’d rather get partial payments than none at all. Asking for help isn’t weakness; it’s smart financial management. The key is to act early, before accounts go to collections, and to put any agreement in writing.

Finally, income protection includes guarding against interruptions. If your job is your primary source of income, maintaining it becomes a financial priority. That means avoiding unnecessary risks—like quitting without a backup plan or taking on volatile side gigs that could interfere with your main work. It also means building small buffers where possible: car maintenance to avoid breakdowns, health routines to reduce sick days, and professional development to increase job security. These aren’t direct debt solutions, but they protect the engine that makes repayment possible.

Strategic Debt Structuring: Smarter, Not Harder

Paying off debt isn’t just about how much you pay—it’s about how you organize what you owe. Many people focus only on increasing payments, but without a clear structure, extra money often gets lost in high-interest traps. Strategic debt structuring is about creating a system that reduces interest costs, prevents new debt, and builds momentum—without requiring heroic sacrifices.

One of the most effective tools is balance transfer. For those with credit card debt, moving high-interest balances to a card with a 0% introductory rate can save hundreds, even thousands, in interest. But this only works if you have a plan to pay off the balance before the promotional period ends and if you avoid adding new charges. Used wisely, it’s a breathing room strategy—not a way to spend more.

Debt consolidation is another option, especially for multiple payments. Combining several debts into a single loan with a lower interest rate simplifies management and can reduce monthly payments. Personal loans, credit union programs, or home equity lines (used cautiously) can serve this purpose. The key is ensuring the new terms are truly better—not just more convenient. A longer repayment period might lower monthly costs but increase total interest over time. Always compare the full cost, not just the monthly number.

When it comes to payoff order, two methods stand out: the avalanche and the snowball. The avalanche method—paying off debts with the highest interest rates first—saves the most money. The snowball method—clearing the smallest balances first—builds psychological momentum. Both work; the best choice depends on your personality. If you need quick wins to stay motivated, snowball may be better. If you want maximum efficiency, go avalanche. The important thing is consistency. Whichever method you choose, stick with it.

The goal of debt structuring isn’t speed—it’s sustainability. You’re not trying to finish fast; you’re trying to finish without breaking. That means avoiding new credit, resisting lifestyle inflation, and monitoring your progress monthly. Small, steady reductions in debt build confidence and create space for future financial goals.

Earning with Guardrails: Safe Income Boosts That Work

When debt looms large, the urge to earn more is natural—and often necessary. But not all income is created equal. Some side hustles promise high returns but come with high stress, time demands, or hidden risks. The goal isn’t just to make more money; it’s to increase cash flow in ways that don’t compromise your health, your job, or your financial stability.

One of the safest paths is skill monetization. If you have experience in writing, bookkeeping, teaching, or crafting, you can offer services part-time through reputable platforms. The key is choosing work that fits your existing routine—like tutoring in the evenings or managing books for a small business on weekends. These roles use skills you already have, so there’s no steep learning curve or upfront cost. Income may start small, but it’s reliable and scalable.

Remote part-time work is another low-risk option. Many companies hire for customer service, data entry, or administrative support roles that can be done from home. These jobs often offer flexible hours and steady pay. While they may not make you rich, they provide consistent income that can be directed straight toward debt reduction. The stability matters more than the amount.

Asset sharing is another underused strategy. Do you have a spare room, a car that sits idle, or tools you rarely use? Renting them out—even occasionally—can generate extra cash without requiring daily effort. A weekend rental of a power washer, a few nights of hosting, or a car shared through a trusted network can add meaningful income. The key is to set limits: define how much time you’ll spend, how much risk you’ll accept, and how the money will be used. Guardrails keep these efforts safe and sustainable.

The real power of these strategies isn’t in their size—it’s in their consistency. An extra $200 a month, applied steadily to debt, can shorten a payoff timeline by years. More importantly, these income streams don’t require you to gamble your security. They work within your life, not against it.

The Hidden Levers: What Most Overlook in Debt Recovery

When people focus on debt, they often look only at income and payments. But real financial resilience comes from a deeper level of management—what we might call the hidden levers. These are the small, often overlooked areas that, when adjusted, free up cash, reduce risk, and create breathing room without major lifestyle changes.

One of the most powerful is insurance review. Many households pay for coverage they don’t need or lack protection they do. Overinsuring a car, duplicating health benefits, or missing out on discounts for safety features can cost hundreds a year. Conversely, being underinsured on your home or health can lead to devastating out-of-pocket costs. A thorough annual review with a licensed agent can identify gaps and savings. It’s not about cutting coverage; it’s about aligning it with your actual needs.

Subscription audits are another quiet drain. Streaming services, gym memberships, software tools—these small monthly charges add up. A family might easily spend $100 or more on subscriptions they barely use. The solution isn’t to cancel everything, but to review each one: Is it used? Is it worth the cost? Can it be paused or downgraded? Even trimming two or three can free up $30–$50 a month—money that goes straight to debt.

Community and nonprofit resources are often overlooked. Many credit unions, religious organizations, and local agencies offer free financial counseling, budgeting workshops, or emergency assistance programs. These services don’t judge; they help. A single session with a certified counselor can uncover strategies you’ve never considered. Some programs even help negotiate with creditors or provide short-term relief for utilities or rent.

These levers don’t make headlines, but they make a difference. They turn passive spending into active control. And when combined, their impact is greater than the sum of their parts. Financial recovery isn’t always about big moves. Sometimes, it’s about seeing what’s already there—and using it better.

Building the Exit Ramp: From Crisis to Control

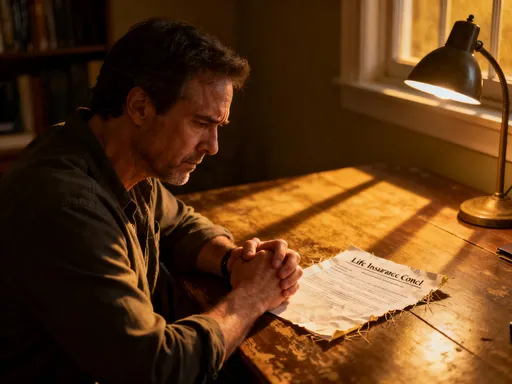

Debt recovery isn’t a sprint; it’s a journey from crisis to control. And like any journey, it needs milestones. The exit ramp isn’t a single moment—it’s a series of steps that mark your return to stability. The first sign of progress is predictability: knowing your bills will be paid, your essentials covered, and your debt slowly shrinking. That predictability brings peace, and peace restores clarity.

Once the immediate pressure eases, the next step is rebuilding the emergency fund. Even a small cushion—a few hundred dollars—can prevent future debt spirals. The goal isn’t to save thousands overnight, but to start. Even $25 a month builds habit and security. This fund isn’t for spending; it’s for protection. It’s what keeps a flat tire from becoming a financial crisis.

Only after stability is restored should you consider cautious growth. This might mean resuming retirement contributions, exploring low-risk investments, or saving for a specific goal like home repairs. The key is to move slowly, with guardrails. Don’t jump back into aggressive strategies. Instead, focus on consistency—small, regular actions that compound over time.

Finally, reflect on what you’ve learned. The debt crisis may have been painful, but it taught you resilience, discipline, and the value of planning. These aren’t just financial skills—they’re life skills. You now understand your limits, your strengths, and the importance of balance. That awareness is your greatest gain.

Lasting financial health isn’t about perfection. It’s about progress. It’s about making thoughtful choices that protect both your present and your future. You don’t need to be rich to be secure. You just need to be consistent, cautious, and clear-eyed. And if you’ve walked through debt and come out stronger, you already have what it takes to build a safer, more stable life—one smart decision at a time.